Real Estate Finance

The Hidden Costs of Purchasing a Brand-New Home

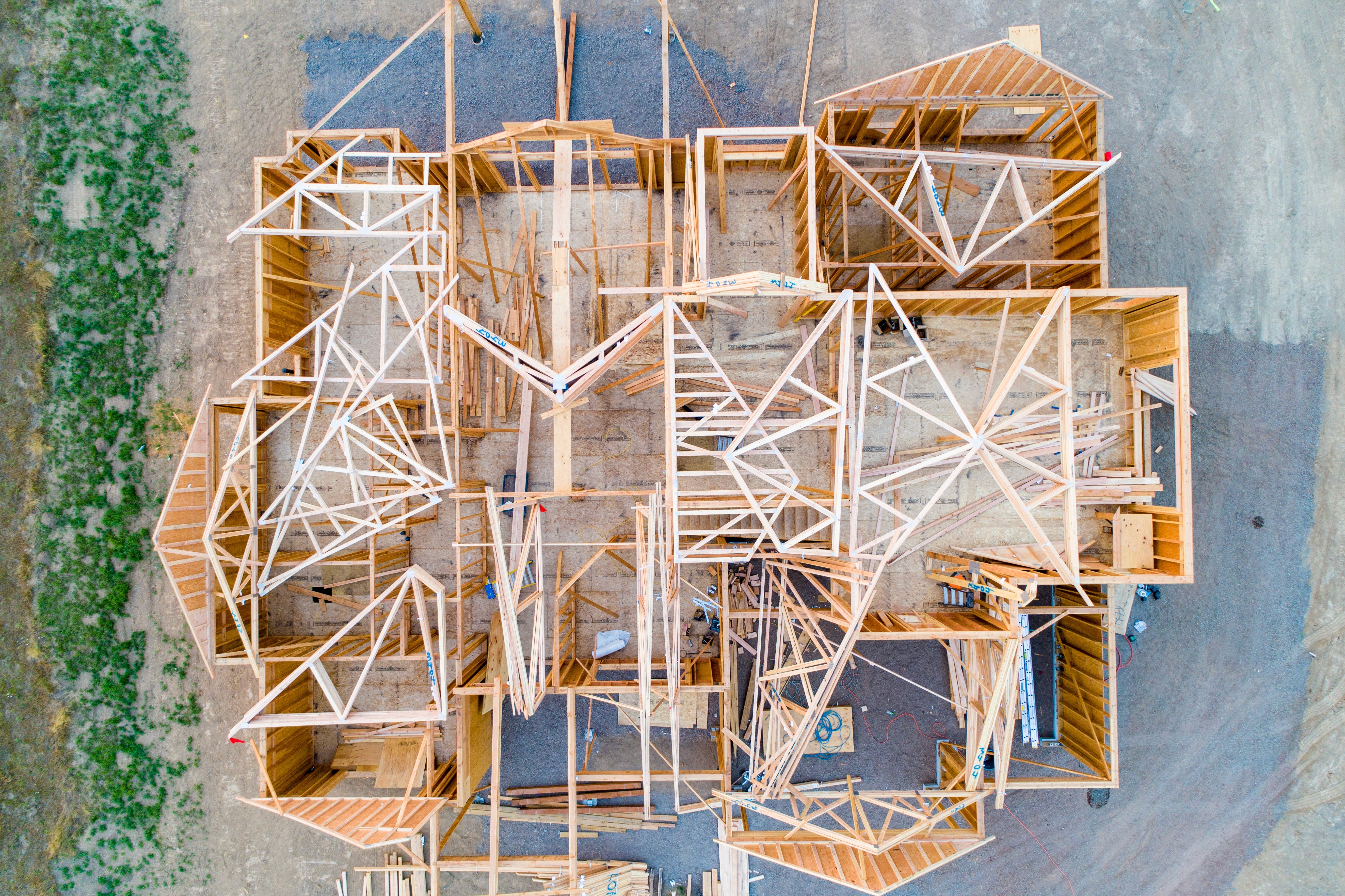

The allure of a brand-new home often captivates homebuyers with its promise of modern design, energy efficiency, and pristine condition. However, beneath the surface of this exciting prospect lie hidden costs that can catch buyers off guard. In this article, we'll unveil some of the concealed expenses associated with buying a brand-new home, allowing prospective buyers to navigate the real estate landscape with informed financial awareness.

1. Upgraded Features and Customization:

Description: While the base price of a new home may seem appealing, many builders showcase model homes with upgraded features. Buyers who desire these enhancements may face additional costs to customize their home to meet their preferences.

2. Landscaping and Exterior Finishes:

Description: New homes often come with basic landscaping, but if buyers wish to enhance the curb appeal or add personalized touches to the exterior, landscaping costs can quickly accumulate.

3. Window Coverings and Blinds:

Description: New homes may not include window coverings or blinds. Purchasing and installing these can be an unexpected expense for homeowners seeking privacy and light control.

4. Appliances and White Goods:

Description: While the kitchen may be equipped with standard appliances, buyers desiring premium or additional appliances may face extra costs. Similarly, white goods like washers and dryers may not be included.

5. Finishing the Basement or Attic:

Description: Some new homes come with unfinished basements or attics. Completing these spaces to add usable square footage can be a significant expense.

6. Homeowners Association (HOA) Fees:

Description: Many new developments are part of homeowners associations, which may impose monthly or annual fees. These fees cover communal amenities and services, adding to the overall cost of homeownership.

7. Utilities and Connection Fees:

Description: Setting up utilities and paying connection fees is often the responsibility of the buyer. These costs can include water, gas, electricity, and internet services.

8. Property Taxes:

Description: Property taxes on a new home may differ from those on the previous land. Buyers should be aware of the local tax rates and potential increases.

9. Window Treatments and Furnishings:

Description: While the home itself is newly constructed, buyers may need to invest in furnishings, window treatments, and decor to make the space feel complete.

10. Extended Warranties and Maintenance Contracts:

Description: Buyers may choose to purchase extended warranties on appliances, HVAC systems, or other features in the home. Maintenance contracts for landscaping or pest control can also contribute to ongoing costs.

11. Cost of Commuting:

Description: Purchasing a new home in a developing area may result in a longer commute to work, potentially increasing transportation costs over time.

12. Future Development Assessments:

Description: In rapidly developing areas, buyers should inquire about future development plans that could lead to additional assessments or fees in the years to come.

Informed Budgeting When Purchasing a New Home

While the prospect of owning a brand-new home is exciting, understanding and preparing for hidden costs is crucial for financial wellness. Prospective buyers can navigate the process with confidence by carefully reviewing contracts, asking questions, and budgeting for both the initial purchase and ongoing expenses. By being proactive and well-informed, homebuyers can ensure a smoother transition into their new home without succumbing to unexpected financial surprises.